Record price rises at London’s most luxurious restaurants means that those charging merely £100 per head no longer fall into the top price category of the only print restaurant guide now widely stocked by London bookshops.

The introduction to Harden’s London Restaurants 2023, now entering its 32nd year of publication (published today, Thursday 10 November), notes a general rise of 8.1% in restaurant prices in the 12 months to August 2022 amongst the 1675 establishments it reviews. Amongst the 58 restaurants charging over £130 per head the rate of increase was 11.7%.

The general rate of increase was a record in the last decade and the highest in the 20 years since 2000 when the guide started calculating price rise data; with the exception of a blip after the recovery from the great crash (when a rate of 11% was briefly registered in 2011).

Fast-rising prices have necessitated lifting the top price category published in the guide to £130 per head, with £100 per head now reserved for the second tier.

Editor Peter Harden comments:

“It was the post-Brexit, 2017 edition (published in autumn 2016) in which we first introduced a £100+ top price band at the front of the book. At that time, there were 37 such entries, of which just one had a formula price over £150 per head.

Fast forward five years, and £100+ is – in this edition – for the first time the delimiter merely of our second highest price category. Our highest band is now set at £130+.

Now, there are 154 entries in the guide above the £100 level. And in a neat symmetry with the figures above, there are 37 restaurants with a formula price over £150 per head.

In fact, there are 17 entries now over £200 per head and six above £250! It feels like everything is speeding up. That’s because it is.”

Openings and Closures

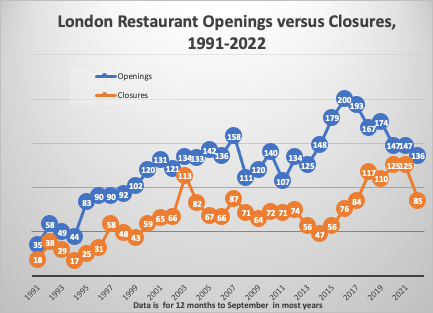

The guide notes that there has been no ‘twang back’, post pandemic, with 136 newcomers recorded as opening in the year: the lowest level of openings since 2011. This rate of new restaurants falls right at the bottom of the range of 134-200 noted in all but two of the last twenty years.

There were 85 closures. This was not a high level, suggesting that in the year leading up to August 2022, a lack of custom was not yet a problem for the trade.

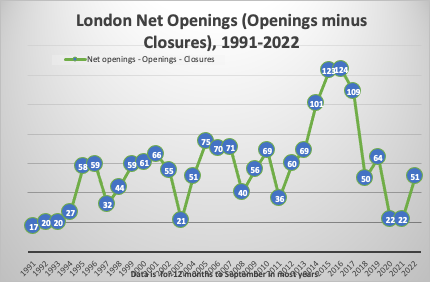

Net growth (Openings minus Closures) was 51. This is a low level by the yardstick of the last 31 years; and well out of the range of the 100+ new openings recorded in 2014-2018, which the guide notes now feels like “a golden era”.

Editor Peter Harden notes:

“Many restaurants were already challenged post-Covid. We saw that in reduced opening times; constant anguish in the trade about disastrous post-Brexit staffing problems; and – amidst rising prices – with consumers’ perception of value starting to dive.

Yet, as the graph of Openings & Closures show, the trade had weathered the pandemic and was starting to attract investment again, albeit of a muted nature.

How this will now play out with the increased challenge of mounting inflation remains to be seen. It is not a good sign that our data precedes the most recent spikes in prices, and yet diners in our poll were already expressing concerns related to these never-before-seen levels of expense.”

Top performers in the Harden’s 2023 Annual Diners Poll

Core by Clare Smyth again topped the poll for where most diners had their best gastronomic experience of the year.

The highest average food rating went to Evelyn’s Table amongst restaurants charging over £130 per head. The guide notes that chef-patrons, the Selby brothers’, “very snug little basement venue for counter-top fine dining shows levels of skill and technique to compete with much better-known places that leave you with a far higher bill” and advise “file this under ‘one to watch’ as they plan to build out the ambition even further”.

Theatreland seafood veteran, J Sheekey, was the poll’s most-mentioned restaurant while Bruce Poole’s neighbourhood star Chez Bruce in Wandsworth topped nominations as diners’ Favourite for the 17th year in a row. Despite worries about Jeremy King’s departure, The Wolseley remained diners’ top choice for a business meal or breakfast and Covent Garden’s Clos Maggiore was again first choice for an important date. The Harwood Arms topped the category for best Bar & Pub.

The Oxo Tower was again the restaurant registering the most disappointments, while the River Café yet again was voted the capital’s most overpriced establishment, with the guide noting that “no one can doubt the quality of the food, even so the gobsmacking prices are hard to justify”.

On the rise: The Middle East

After Modern British (26) openings, Italian cuisine was this year’s favourite (with 18 debuts), beating Japanese cuisine, which was last year’s runner up, into third place (with 9 openings). This year’s most promising rising star cuisines were Middle Eastern (accounting for 8 openings).

Tourist-dominated Central London is where the action is

In terms of location, Central London was unusually dominant, accounting for 57 arrivals. In the ’burbs, East London led the way (with 25 openings) just beating South London (with 23). West London registered a poor year (16), only just exceeding North London’s rate of opening (15).

Editor Peter Harden comments:

“Travel has returned post-pandemic, and entrepreneurs continue to open exciting newcomers in the West End to capitalise on the boost provided by the return of tourism.

But outside the centre, Working from Home may have been a boon to the existing restaurant trade, but WFH hasn’t yet inspired a rush to invest in new openings in those areas.”

Notes for editors

1. Harden’s is the UK’s original restaurant survey, using market research principles to evaluate how well restaurants are performing. The Harden’s survey of diners is now in its 32nd year. It has been national in scope since 1999.

2. Harden’s is published in autumn each year. The statistics and graphs in this release are presented in relation to calendar year, not publication year. So, for example, the statistics shown as “2003” were published in autumn 2003 in the Harden’s guide titled 2004.

3. Prices in the Harden’s guide, website and app are based on a formula explained as follows: The price shown for each restaurant is the cost for one (1) person of an average three-course dinner with half a bottle of house wine and coffee, any cover charge, service and VAT. Lunch is often cheaper. With BYO restaurants, we have assumed that two people share a £7 bottle of off-licence wine.

4. Prices are gathered by a data collection exercise conducted between April and July taking prices from restaurant menus as published on their websites.

5. Unlike restaurant review sites like TripAdvisor, Harden’s has never published its surveyees’ raw reports online, to prevent ballot-stuffing. Having no access to raw user reviews makes it much harder to “game” the Harden’s system, because it is impossible to gauge how much false data to submit to do so. What’s more, Harden’s longstanding core of reviewers – some of whom have been participating for over 20 years – provides a control group by which to access reports from newer respondents.

6. Harden’s content is available as an app for iPhone and Android as well as being published as a guidebook. The print version is now the only annual restaurant ratings guide widely stocked in London bookshops. 7. Harden’s London Restaurants 2023, £16.99, is available in all good bookshops, including Waterstone’s and Amazon.com, and from www.hardens.com!