😵 Closure rate lowest in a decade

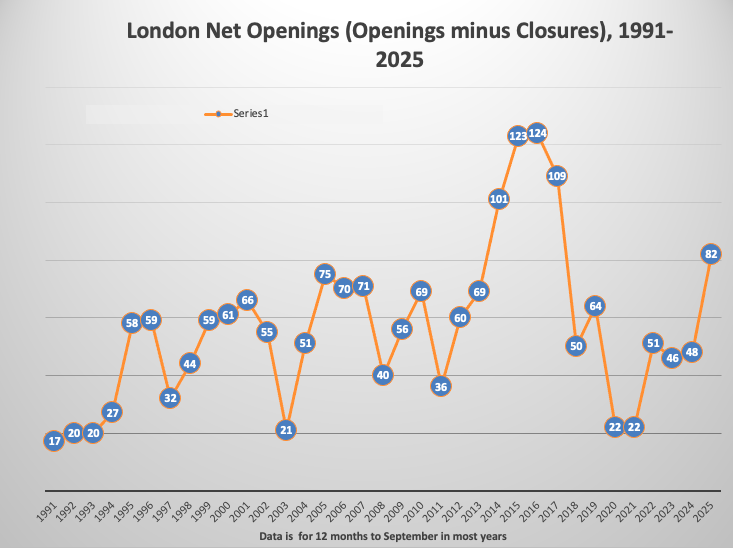

🚀 Net openings the highest since Brexit

📈 Prices rises at expensive restaurants double that of cheaper ones

The capital is experiencing a restaurant opening rate consistent with the start of a boom according to the latest figures featured in the new edition of Harden’s London Restaurants 2026 (published today).

The latest edition challenges the “gloomsterism” that editor Peter Harden says currently grips the UK hospitality trade, revealing a healthy growth level in the number of restaurant openings in London in the past year.

Peter says: “Gloomsterism grips the hospitality trade. Over the last year there has been a relentless bombardment of statements from bodies within the sector describing the dire state of the hospitality industry but – from what we’re seeing in London at least – this just doesn’t fit the facts!

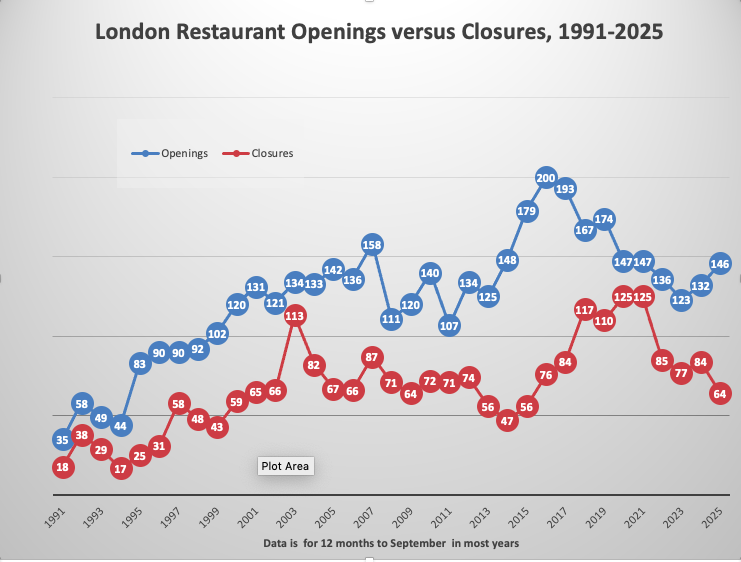

“In the last 12 months, the Harden’s London Restaurants guide has tracked 146 new openings. Except for the boom years of 2013-2017, this is a very perky growth level. As to the rate of closures: it was 65. There is no denying that some of these closures were fine establishments, sadly gone before their time, but we still must accept that this is the lowest rate of closures amongst quality restaurants in a decade.”

The guide notes that this year’s net growth rate of 81 is exceeded by only four other years in the last 35 over which the guide has tracked such stats – a result more consistent with the start of a boom than the end being nigh.

Peter Harden adds: “We accept that our guide focuses on quality establishments rather than all hospitality outlets and that the growth rate we’re seeing says nothing about the current profitability of hospitality businesses, but that does not invalidate the general picture that there are healthy, bright spots within the country and the suggestion from our figures that investors scent future gains in backing these new openings.”

The guide cites a number of potential reasons for the gap between its figures and the “devastating outlook widely reported elsewhere”. One factor is the low confidence level amongst all UK business executives generally (as reported by the IOD Directors’ Economic Confidence Index at the end of July). Another possibility put forward is specific factors benefiting the capital. London’s population has grown 2% in the last 2 years and tourism has grown strongly in 2024 and 2025.

Peter says: “Our analysis is not to suggest that the restaurant trade is dreaming up the many big challenges facing it. National Insurance rises, post-Brexit visa issues, post-pandemic knock-ons, ever-greater employee protections and above-average food price inflation all make it harder than ever to balance the books. However, the number of quality restaurants that remain open in the capital is a positive sign that speaks to the tenacity and resourcefulness of those operating in the sector and clearly results in people still being prepared to invest in opening new ones. Operators are without doubt facing an array of adversities, but they are still keeping the show on the road somehow – the music has not yet stopped!”

📈 Two-speed Britain – a top meal in London is an ever-pricier luxury

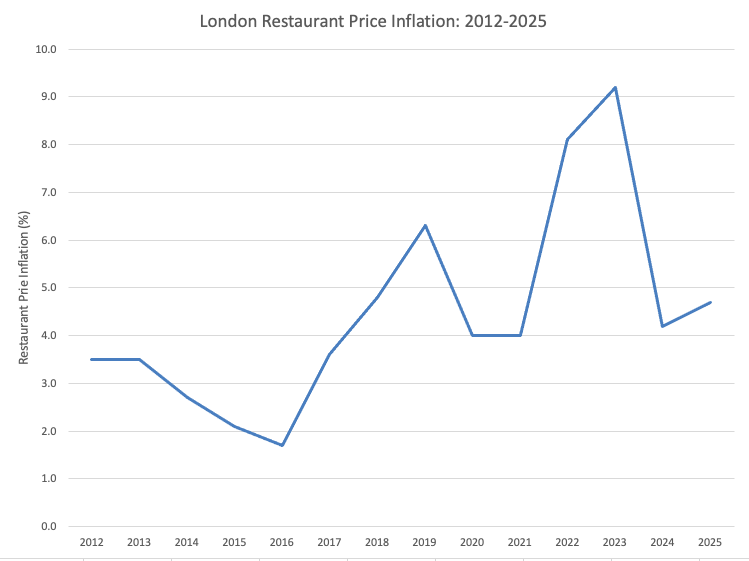

While the Harden’s figures for net openings show encouraging growth in the London trade, the guide’s statistics for prices reveal spikes that may reflect the choppy waters that restaurants are currently navigating.

The average formula price of dinner for one at entries in the 2026 guide is £82.58 (compared to £78.84 last year). This increase of 4.7% is above general price growth of 3.6% (as judged by CPI growth for the 12 months to June 2025), and up on the 4.2% noted in the last edition of Harden’s.

Strikingly, the more expensive the restaurants, the greater the price increase: for those charging £100+ per person, the increase was a yet-higher 6.8% and for those charging £150+ per person, a yet-higher 8.6%.

Peter comments: “London’s top restaurants seem willing to put their prices up more because wealthier consumers are less cost-sensitive, so the market will bear the restaurants passing on rising costs due to National Insurance and food inflation. Whereas amongst the cheaper and mid-range establishments, price hikes are more likely to result in loss of business, so owners are accepting squeezed margins or trimming their offer rather than passing on the full increase in supplier-costs.”

The guide also highlights the decreasing level of affordability of a meal in the capital’s top restaurants to middle class Londoners. According to comparisons between figures in the 2026 and 2016 guides, the last 10 years has seen an average price-rise amongst the top 5 awards by Michelin (Alain Ducasse, Hélène Darroze, The Ledbury, Restaurant Gordon Ramsay, Sketch) of 130%. Allowing for inflation, this is a 65% rise in real terms. Combine this trend with the emergence of a super-tier of predominantly Japanese restaurants that cost significantly more, and dining out in London’s premier establishments seems like an increasingly rare treat for consumers.

🥇 London’s top eateries

In pure culinary terms, Harden’s London Restaurants 2026 reveals Jason Atherton’s ROW on 5 with chef Spencer Metzger as the most important opening of the year, immediately taking its place amongst the capital’s most impressive destinations. Other notable performances this year include Oma (straight in at No. 14 in the guide’s Top 40 most mentioned list) and Cornus (entering the same Top 40 at No. 31). Core by Clare Smyth was again voted Londoner’s Top Gastronomic Experience and – for an impressive 20th year – Chez Bruce on Wandsworth Common was voted London’s Favourite Restaurant.

🕶 ‘London Med’ on the up

In terms of the capital’s favoured cuisines, Japanese rode high this year (with 11 openings) and came in third place to the two cuisines that practically always dominate: Modern British and Italian openings (which account for 25 and 15 launches respectively). However, Mediterranean openings were a strong fourth (with 9 debuts) and if added to the overlapping categories classed as Greek (5 openings) and Middle Eastern (5 openings) – it could reasonably be said that the ‘London Med’ trend is one to watch.

Notes for editors

For further information, images, or for interview requests with Peter Harden please contact Sarah Harding on 07594 373589 or email sarah@jelly-comms.com

1. Harden’s is the UK’s original restaurant survey, using market research principles to evaluate how well restaurants are performing. The Harden’s survey of diners is now in its 35th year. It has been national in scope since 1999.

2. Harden’s is published in autumn each year. The statistics and graphs in this release are presented in relation to calendar year, not publication year. So, for example, the statistics shown as “2004” were published in autumn 2004 in the Harden’s guide titled 2005.

3. Prices in the Harden’s guide, website and app are based on a formula explained as follows: The price shown for each restaurant is the cost for one (1) person of an average three-course dinner with half a bottle of house wine and coffee, any cover charge, service and VAT. Lunch is often cheaper. With BYO restaurants, we have assumed that two people share a £7 bottle of off-licence wine.

4. Prices are gathered by a data collection exercise conducted between April and July taking prices from restaurant menus as published on their websites.

5. Unlike restaurant review sites like TripAdvisor, Harden’s has never published its diners’ raw reports online, to prevent ballot-stuffing. Having no access to raw user reviews makes it much harder to “game” the Harden’s system, because it is impossible to gauge how much false data to submit to do so. What’s more, Harden’s longstanding core of reviewers – some of whom have been participating for over 20 years – provides a control group by which to access reports from newer respondents.

6. Harden’s content is available as an app for iPhone and Android as well as being published as a guidebook. The print version is now the only annual restaurant ratings guide widely stocked in London bookshops.

7. Harden’s London Restaurants 2026, £17.99, is available in all good bookshops, including Waterstone’s and Amazon.com, and from www.hardens.com